Today, the Chancellor set out a range of measures in the Autumn Statement – here’s how the new measures affect our industry

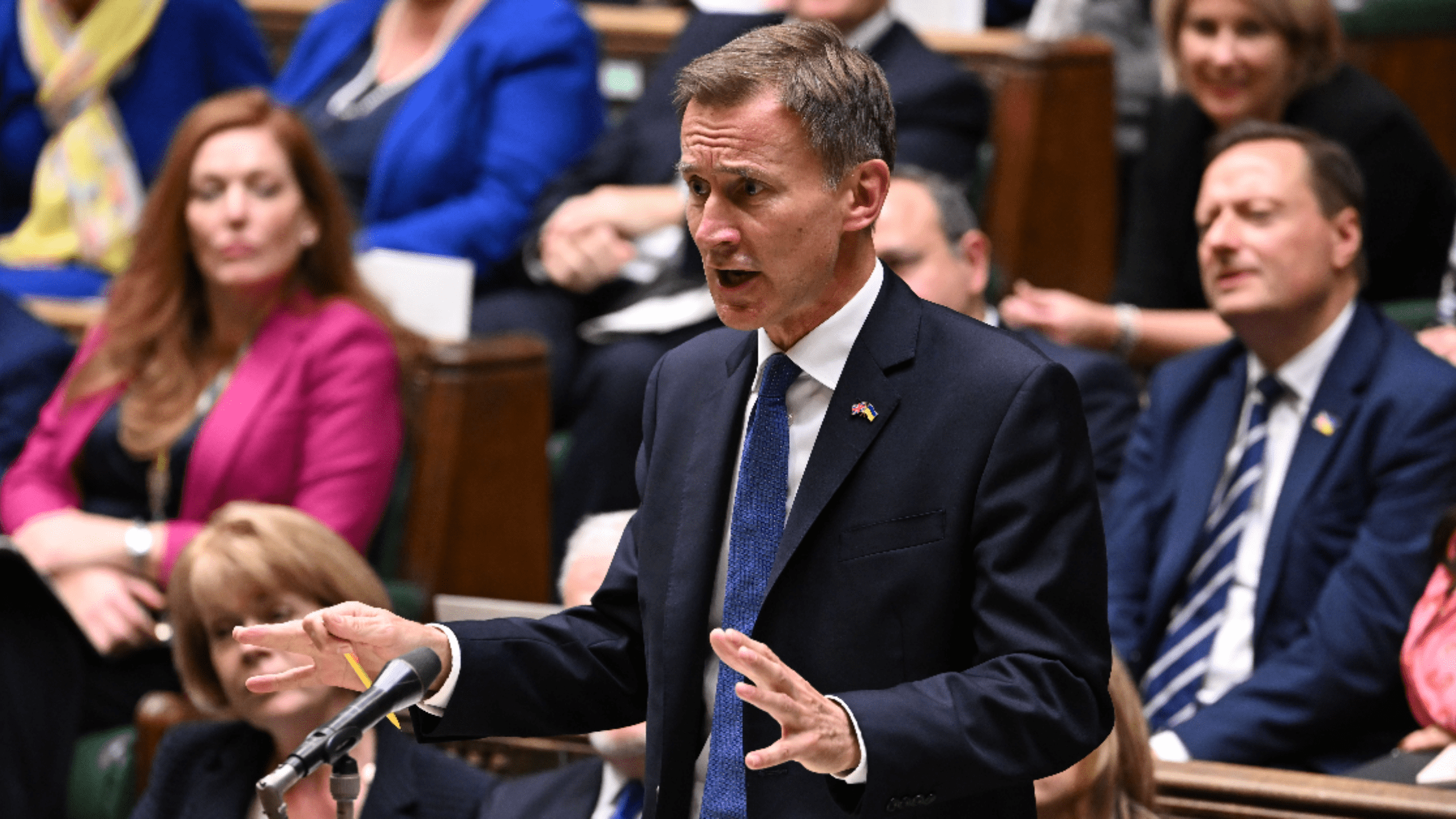

Jeremy Hunt took to the House of Commons despatch box this morning to reveal the government’s 2022 Autumn statement. The fiscal measures, designed to mend the nation’s finances, focus on tax rises and spending cuts.

Here’s how the measures will affect the beauty industry:

1. Business rates:

From April 2023, many businesses will be facing new business rates to reflect current market conditions. Firstly, the rates multiplier will be frozen for another year to protect businesses from inflation. The government has also increased its business rates relief scheme from 50% to 75%. This extension also means that more properties are eligible for discounts from local councils.

Businesses that see bill increases and decreases due to this business rates reevaluation will be protected. For bills that drop, the government is ensuring business owners benefit from that decrease in full straight away by abolishing downward transitional relief caps. The Chancellor has also announced a £1.6 billion scheme to cap costs for business rates bills that increase.

2. Wages

This morning, the Chancellor announced that the legally-enforceable minimum wage for people aged over 23 will increase from £9.50 to £10.42 an hour from next April. Also, state pension payments and means-tested and disability benefits will increase by 10.1%, in line with inflation.

3. Energy Support

The government’s Energy Bill Relief Scheme has been extended, this ensures that domestic properties will continue to receive support on energy bills until March 2024. However, the protection measures have been reduced. From April 2023, support will be capped so that a typical household pays £3,000 (up from £2,500) for the next 12 months.

If you are looking for information on continued energy support for commercial properties, you’ll have to wait. The Chancellor has comitted to making an announcement about post March 2023 support before the end of the year.

4. Taxes:

Various tax thresholds will be frozen until April 2028, including income tax and national insurance. Historically, these thresholds have risen as the cost of living has increased to prevent people’s earnings from being squeezed. The freeze also means that as more people’s wages rise over the coming years, they will sit in higher tax bands.

On the Autumn Statement, Victoria Brownlie, Chief Policy Officer at the British Beauty Council, says:

‘The statement doesn’t go far enough to support vulnerable small businesses. Hair salons are just one example of many beauty businesses that are on a cliff edge due to escalating costs. Since Covid 19, there has been an increased demand for these services, proving they contribute more to society than just the £6bn they generate for the UK economy.

‘This demand has not been met with further support for energy bills, which will tip many over the edge, forcing them to close. Data shows energy costs have increased by an average of 148 per cent, with some even exceeding 200 per cent.

‘Whilst the increase in business rates relief is welcome, the freezing of VAT and NI thresholds will be a blow to many small businesses. High street hairdressers are in demand, employing local people. To lose them would leave high streets empty and some of the poorest communities with increased unemployment.’