With the support of hair professionals, industry influencers and journalists, a newly formed sub-committee of the British Beauty Council have launched the #ChopTheVAT campaign.

The #ChopTheVAT campaign is asking the UK Government to cut the VAT for hair salons from 20 percent down to 5 percent, as they have done for the hospitality industry.

Sonia Haria, Beauty Director at the Telegraph, spoke with a number of Hair professionals about #ChopTheVAT. See below to find out what they said:

“Luke Hersheson, owner of five salons in London employing 150 staf

As it stands: Pre-Covid, we were enjoying our highest turnover to date. Since reopening in July, my income has dropped by 80 per cent at our blow dry bars, which are directly linked to people going out. Customers are confused as to the messaging around what they should or should not be doing.

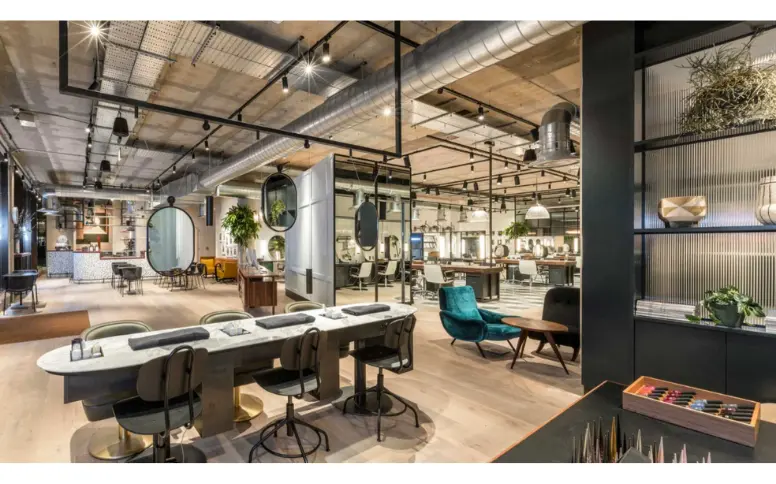

What we need: The margins in hairdressing service are as slim as those in the hospitality sector – shrinking the VAT will have an immediate effect in the cash flow of every hairdressing business in the UK, stopping further redundancies and helping to keep the lights on. This crisis is about survival.”

Hershesons Berners Street | Image Credit: VOGUE

“Nicola Clarke, runs Nicola Clarke at John Frieda employing 80 people working over 2 salons

As it stands: I am 40 per cent down in revenue because we are working at half capacity and doing all we can do to keep people safe. Some people are still worried about making the journey to salons despite great feedback from how the hair industry is tackling sanitisation and social distancing.

What we need: A commitment to a 15 percent reduction in VAT. We are trying our best to keep going and can mitigate the risks, but the drop is revenue is drastic.”

Nicola Clarke at John Frieda | Image Credit: GLAMOUR

“John Vial, owner of Salon Sloane in London employing 15 staff

As it stands: As a salon owner, I tread water daily. My rent is expensive, and the drop in hospitality is directly impacting our business. Many clients are choosing to only highlight and colour the front of their hair – as they are only seen head-on on Zoom – so their bills are far lower. Pre-Covid, most of our clientele would come in for a blow dry before dinner or the theatre, but now they say “why get dressed up when there is nowhere to go?”

What we need: It seems only fair and decent to extend the VAT reduction to hairdressers given that the downturn in hospitality has impacted our business. We are down in trade on average 40 per cent, and the salon is only getting quieter.”

Salon Sloane | Image Credit: Salon Sloane

“Josh Wood, owner of eponymous salon in London and employer of 75 staff

As it stands: According to a survey of 1,000 of our clients, over a third have not returned to salons in the UK yet since lockdown. Despite social distancing measures reducing capacity and increasing our costs, we have received no extra support.

What we need: Hair salons have been ravaged by the impact of lockdown and we need to be part of the reduced VAT rate. Salons are doing their bit to keep clients safe and it feels time for the Government to do its bit and keep the industry afloat.”

Josh Wood Atelier | Image credit: GLAMOUR

“Josh Miller, owner of five salons in Edinburgh employing 120 people

As it stands: When we re-opened in July, we had a tidal wave of appointments, but after the initial rush, it has been quiet. Inner city salons seem to be particularly hit, because so many people are working from home.

What we need: It is going to be tight for the next six months to a year. Hairdressing is less profitable than ever, as the overheads are so much. People are coming less often, not like in the Eighties when you had your hair done came every 4-6 weeks.”

Charlie Miller Salons | Creator: Aaron Zaccardelli Copyright: © ZAC and ZAC

Please share this post across your social and let’s help our hairdressers remain the beating heart of our high streets and big cities.

Read all about the #ChopTheVAT campaign in today’s Telegraph.

To download the #ChoptheVAT Campaign imagery, here are the links: