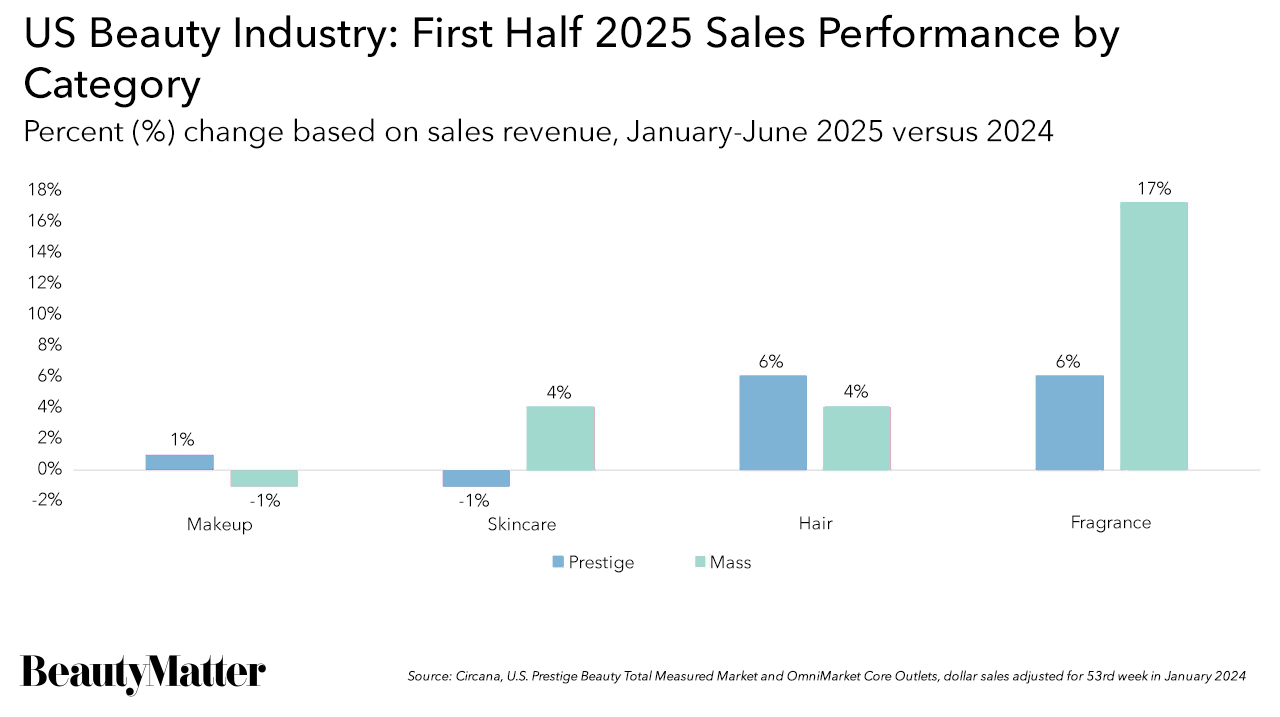

According to Circana data, the US prestige beauty market grew by 2% to $16 billion, while sales at mass merchants increased 4% to $34.6 billion in the first half of 2025

“The beauty industry’s latest results are indicative of a consumer who is focused on efficacy and elevated value,” said Larissa Jensen, global beauty industry advisor at Circana. “Only 14% of US beauty buyers believe that higher prices indicate a better-quality product. The mass and prestige markets are converging, with premium-priced brands in mass retail and value-priced prestige brands outperforming their counterparts. As the industry faces tariff uncertainties and shifting consumer sentiment, adaptability and strategic agility are essential for success in 2025.”

Fragrance

- The largest growth in prestige was in the fragrance category. Sales increased by 6% to $3.9 billion and grew on all metrics including units sold and average selling price.

- Sales accelerated in the second quarter compared to the first quarter, with new fragrance brand launches playing a significant role in this growth.

- New products represented nearly one-third of total fragrance dollar gains.

- High concentrations, particularly eau de parfums and parfums, continued to drive the most significant impact.

- Simultaneously, consumers gravitated towards more affordable options, with mini/travel size juices growing by 15% in units sold—nearly four times the rate of other sizes.

- Fragrance was the fastest-growing category in the mass market, up 17% based on dollar sales, and driven by women’s fragrances.

- 80% of volume comes from prestige, so mass is a smaller piece that’s growing faster.

Hair

- The prestige hair category showcased a 6% increase to $2.3 billion, and units sold were also up.

- All prestige hair segments reported growth, ranging from a single-digit increase for shampoos and conditioners to a double-digit lift in styling products.

- New product launches outpaced total sales, particularly in treatments.

- Scalp care also remained strong in the first half of the year, up 19%.

- Hair wellness continues to do well. More people believe that styling their hair is a part of their wellness routines.

- Products that address hair thinning and promote hair growth are growing at double the rate of the category.

- In contrast, the overall hair category had a softer performance in the mass channel, with dollar sales up 4% and units flat.

- On the mass side, commoditized business pillars like shampoo and conditioner drove growth.

Makeup

- The makeup sector within prestige retail posted $5.2 billion, reflecting a modest growth of 1% while units sold remained flat.

- Makeup sold in mass outlets declined in the low single digits based on both dollars and units.

- Lip products emerged as the top contributor in prestige makeup, despite a slowdown to 3% growth, and were the only growth area for cosmetics sales in the mass channel.

- The lip segment is increasingly driven by hybrid products that offer both tint and skincare benefits.

- Lip contouring remains a prominent trend for prestige sales, with lip liner being one of the fastest-growing areas.

- The prestige eye makeup segment showed improved performance, reversing last year’s decline, driven in large part by growth in mascara sales.

- Face makeup, the largest segment in prestige cosmetics, remained flat.

Skincare

- Skincare sold in the mass market outperformed prestige.

- Mass skincare sales increased by 4% based on dollars and grew in terms of units sold.

- Prestige skincare dollar sales declined 1% to $4.6 billion, although units sold did increase.

- Masstige brands led the skincare market, with double-digit growth.

- The decline in prestige skincare is primarily attributed to facial skincare sales declines in brick-and-mortar stores.

- The prestige body segment continued to thrive, with body creams, cleansers, and hand soaps the most significant contributors to growth.

This content was originally published on https://beautymatter.com/, you can read the original article here.