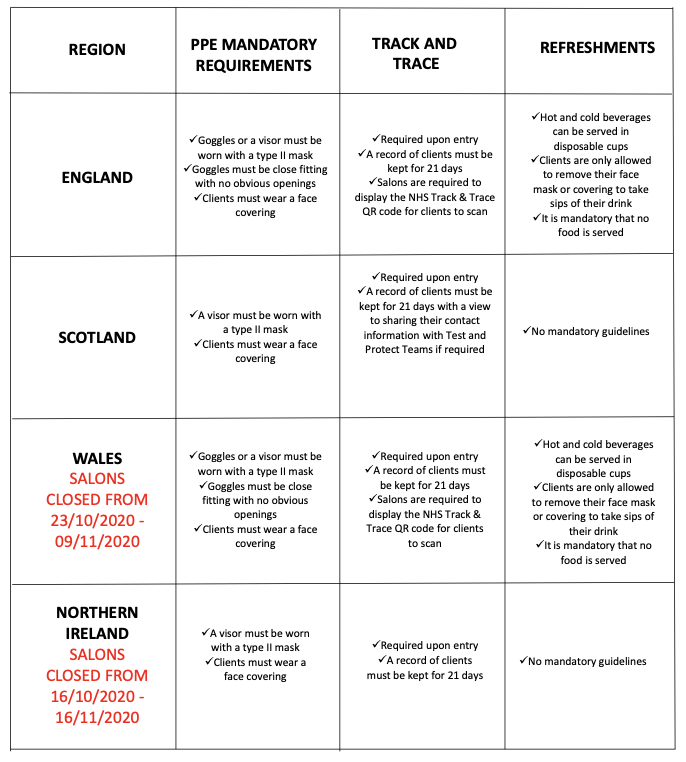

L’Oréal Professional have published an updated salon support guide, which covers England, Wales, Scotland and Northern Ireland.

L’Oréal Professional Products Division have put together a useful Salon Support Guide which spans social media, communications advice, consumer insights and much more.

“We are thinking of all of our hairdressing partners and your loved ones at this time. We want to affirm our total solidarity and are here to help you to navigate this challenging moment. Together with Industry Trade Bodies, we are working to provide you with useful information – with care for you, your teams and your clients as the number one priority. We know that salons and hairdressers are the beating heart of the community – we share our love and wish everyone well.”

Béatrice Dautzenberg, Managing Director – L’Oréal Professional Products Division UK & Ireland

Image credit: L’Oréal Professional Products Salon Support Guide

COVID-19 Support Information

COVID-19 England

JOB SUPPORT SCHEME

- Replaces the previous furlough scheme, starting from 1st November

- The government is providing additional support to help employers retain their employees

- Those businesses that are legally required to close their premises as a direct result of coronavirus restrictions can get the support, they need through JSS Closed.

- The employee will need to work a minimum of 20% of their usual hours and the employer will continue to pay them as normal for the hours worked. Alongside this, the employee will receive 66.67% of their normal pay for the hours not worked – this will be made up of contributions from the employer and from the government.

- https://www.gov.uk/government/publications/the-job-support-scheme/the-job-support-scheme

JOB RETENTION BONUS

- Employers using the Job Support Scheme will also be able to claim the Job Retention Bonus if they meet the eligibility criteria.

- The Job Retention Bonus is a £1,000 one-off taxable payment to you (the employer), for each eligible employee that you furloughed and kept continuously employed until 31 January 2021

- You will be able to claim it between 15 February 2021 and 31 March 2021

- Find out if you’re eligible to claim the Job Retention Bonus and what you need to do to claim it https://www.gov.uk/government/collections/coronavirus-job-retention-scheme

LOCAL RESTRICTIONS SUPPORT GRANT

- Supports businesses that have been required to close due to temporary COVID-19 local lockdown restrictions imposed by the government.

- Additional funding to support cash grants of up to £2,100 per month primarily for businesses in the hospitality, accommodation and leisure sector who may be adversely impacted by the restrictions in high-alert level areas.

- These grants will be available retrospectively for areas who have already been subject to restrictions and come on top of higher levels of additional business support for Local Authorities moving into Tier 3

- https://www.gov.uk/guidance/check-if-youre-eligible-for-the-coronavirus-local-restrictions-support-grant

THE SELF-EMPLOYED INCOME SUPPORT SCHEME

The Self-Employed Income Support Scheme will continue, with grants increasing to 40% of previous earnings, the maximum grant will increase from £1,875 to £3,750. There will be two further grant payments, covering the three months from November to January and February to April.

These grants will be available for any self-employed person who has either been ordered to temporarily stop trading, or who is facing significantly reduced demand, regardless of whether they live in a Tier 1, 2 or 3 area.

RETURN TO WORK SAFELY PROTOCOL

View the Official UK Covid-19 Guidelines for Close Contact Services here https://www.gov.uk/guidance/working-safely-during-coronavirus-covid-19/close-contact-services

For more information visit https://www.gov.uk/coronavirus/business-support

Image credit: Professional Beauty

COVID-19 SCOTLAND

JOB SUPPORT SCHEME

- Replaces the previous furlough scheme, starting from 1st November

- The government is providing additional support to help employers retain their employees

- Those businesses that are legally required to close their premises as a direct result of coronavirus restrictions can get the support, they need through JSS Closed.

- The employee will need to work a minimum of 20% of their usual hours and the employer will continue to pay them as normal for the hours worked. Alongside this, the employee will receive 66.67% of their normal pay for the hours not worked – this will be made up of contributions from the employer and from the government.

- https://www.gov.uk/government/publications/the-job-support-scheme/the-job-support-scheme

JOB RETENTION BONUS

- Employers using the Job Support Scheme will also be able to claim the Job Retention Bonus if they meet the eligibility criteria.

- The Job Retention Bonus is a £1,000 one-off taxable payment to you (the employer), for each eligible employee that you furloughed and kept continuously employed until 31 January 2021

- You will be able to claim it between 15 February 2021 and 31 March 2021

- Find out if you’re eligible to claim the Job Retention Bonus and what you need to do to claim it https://www.gov.uk/government/collections/coronavirus-job-retention-scheme

THE SELF-EMPLOYED INCOME SUPPORT SCHEME

- The Self-Employed Income Support Scheme will continue, with grants increasing to 40% of previous earnings, the maximum grant will increase from £1,875 to £3,750. There will be two further grant payments, covering the three months from November to January and February to April.

These grants will be available for any self-employed person who has either been ordered to temporarily stop trading, or who is facing significantly reduced demand, regardless of whether they live in a Tier 1, 2 or 3 area.

CORONAVIRUS RESTRICTION FUND

- £48 million in funding for businesses and employees in Scotland affected by the temporary COVID-19 brake restrictions that came into effect on 9 October 2020.

- The business closure fund will operate as a two-tiered scheme:

- 1. A smaller grant of £2,875 for businesses with a Rateable Value (RV) of up to and including £51,000

- 2. A larger grant of £4,310 for businesses with a RV of £51,001 or above, up to a maximum of £21,000 in total for any eligible business operating multiple premises

- The discretionary business hardship fund will support some companies that can remain open but are directly impacted by the restrictions. It will operate as a two-tiered scheme depending on Rateable Value:

- 1. A smaller payment of £1,440 for businesses with a Rateable Value (RV) of up to and including £51,000

- 2. A larger payment of £2,155 for businesses with a RV of £51,001 or above, up to a maximum of £14,000 in total for any eligible business operating multiple premises https://www.gov.scot/publications/coronavirus-covid-19-restrictions-fund/pages/the-new-support-fund/

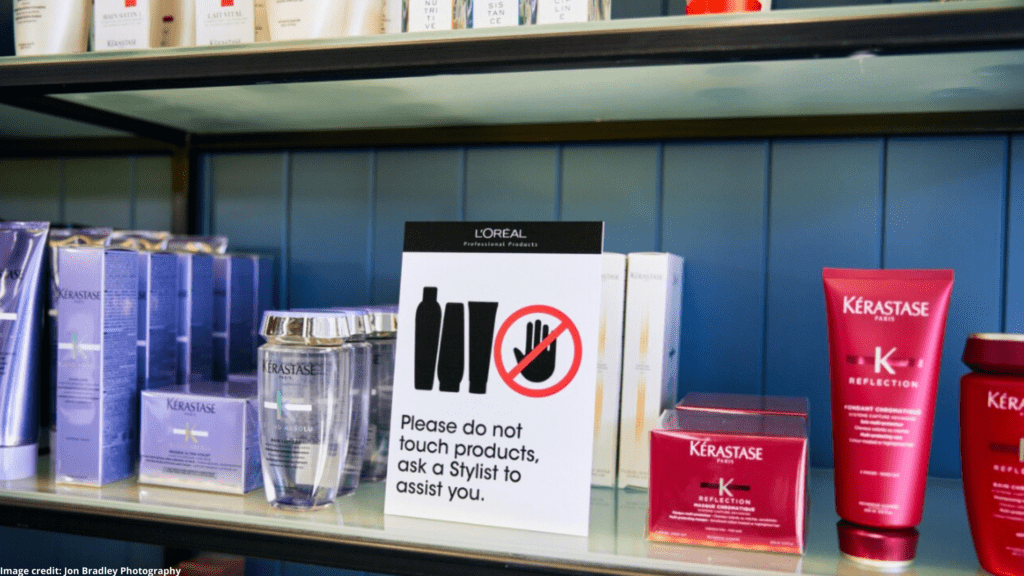

Image credit: Jon Bradley

COVID-19 WALES

JOB SUPPORT SCHEME

- Replaces the previous furlough scheme, starting from 1st November

- The government is providing additional support to help employers retain their employees

- Those businesses that are legally required to close their premises as a direct result of coronavirus restrictions can get the support, they need through JSS Closed.

- The employee will need to work a minimum of 20% of their usual hours and the employer will continue to pay them as normal for the hours worked. Alongside this, the employee will receive 66.67% of their normal pay for the hours not worked – this will be made up of contributions from the employer and from the government.

- https://www.gov.uk/government/publications/the-job-support-scheme/the-job-support-scheme

JOB RETENTION BONUS

- Employers using the Job Support Scheme will also be able to claim the Job Retention Bonus if they meet the COVID SUPPORT INFORMATON – WALES eligibility criteria.

- The Job Retention Bonus is a £1,000 one-off taxable payment to you (the employer), for each eligible employee that you furloughed and kept continuously employed until 31 January 2021 You will be able to claim it between 15 February 2021 and 31 March 2021

- Find out if you’re eligible to claim the Job Retention Bonus and what you need to do to claim it https://www.gov.uk/government/collections/coronavirus-job-retention-scheme

THE SELF-EMPLOYED INCOME SUPPORT SCHEME

- The Self-Employed Income Support Scheme will continue, with grants increasing to 40% of previous earnings, the maximum grant will increase from £1,875 to £3,750. There will be two further grant payments, covering the three months from November to January and February to April.

- These grants will be available for any self-employed person who has either been ordered to temporarily stop trading, or who is facing significantly reduced demand, regardless of whether they live in a Tier 1, 2 or 3 area.

ECONOMIC RESILIENCE FUND

- Businesses across Wales can now find out if they can apply for funding from the third phase of the Economic Resilience Fund

- £80 million worth of business development grants will be open to micro businesses, SMEs and large businesses:

- Micro businesses (employing between 1 and 9 people) will be able to apply for up to £10,000

- SMEs (employing between 10 and 249 people) will be able to apply for up to £150,000

- Large businesses (employing 250+ people) will be able to apply for up to £200,000 https://businesswales.gov.wales/news-and-blogs/news/economic-resilience-fund-phase-3

RETURN TO WORK SAFETY PROTOCOL

Click here to view the full Covid-19 safety protocol for Wales https://gov.wales/hairdressing-and-barber-businesses-coronavirus-workplace-guidance

Image credit: The Irish Times

COVID-19 NORTHERN IRELAND

JOB SUPPORT SCHEME

- Replaces the previous furlough scheme, starting from 1st November

- The government is providing additional support to help employers retain their employees

- Those businesses that are legally required to close their premises as a direct result of coronavirus restrictions can get the support, they need through JSS Closed.

- The employee will need to work a minimum of 20% of their usual hours and the employer will continue to pay them as normal for the hours worked. Alongside this, the employee will receive 66.67% of their normal pay for the hours not worked – this will be made up of contributions from the employer and from the government.

- https://www.gov.uk/government/publications/the-job-support-scheme/the-job-support-scheme

JOB RETENTION BONUS

- Employers using the Job Support Scheme will also able to claim the Job Retention Bonus if they meet the eligibility criteria.

- The Job Retention Bonus is a £1,000 one-off taxable payment to you (the employer), for each eligible employee that you furloughed and kept continuously employed until 31 January 2021

- You will be able to claim it between 15 February 2021 and 31 March 2021

- Find out if you’re eligible to claim the Job Retention Bonus and what you need to do to claim it https://www.gov.uk/government/collections/coronavirus-job-retention-scheme

THE SELF-EMPLOYED INCOME SUPPORT SCHEME

- The Self-Employed Income Support Scheme will continue, with grants increasing to 40% of previous earnings, the maximum grant will increase from £1,875 to £3,750. There will be two further grant payments, covering the three months from November to January and February to April.

- These grants will be available for any self-employed person who has either been ordered to temporarily stop trading, or who is facing significantly reduced demand, regardless of whether they live in a Tier 1, 2 or 3 area

RETURN TO WORK SAFETY PROTOCOL

Click here to view the full safety Covid-19 safety protocol for Northern Ireland https://www.nibusinessinfo.co.uk/content/coronavirus-working-safely-different-business-settings